|

Income and

Eligibility

|

|

B. Defining and using income

|

| Revised: February

8, 2005 |

Effective May 28, 2004

|

WAC 388-290-0065 How does the WCCC program define

and use my income?

We use your countable income when determining your eligibility and

copayment. Your countable income is the sum of all income listed in

WAC 388-290-0060

minus any child support paid out (through a court order, division of

child support administrative order, or tribal government order).

- To determine your income we:

- Determine the number of months, weeks or pay periods it took

your family to earn the income and divide the income by the number

of months, weeks or pay periods to get an average monthly amount;

or

- Use the best available estimate of your family's current

income when you begin new employment or if you don't have an

income history to make an accurate estimate of your future income,

we may ask your employer to verify your income.

- If you receive a lump sum payment (such as money from the sale

of property or back child support payment) in the month of

application or during your WCCC eligibility we:

- Divide the lump sum payment by twelve to come up with a

monthly amount; and

- Add the monthly amount to your expected average monthly income

for the month it was received and the remaining months of the

current authorization period;

- You must meet income guidelines for WCCC after the lump sum

payment is applied to remain eligible for WCCC.

|

Click on the Washington State Register

(WSR) numbers below to go to the official filings for this WAC at the

Washington State Code Reviser's web site.

Current Version: WSR

04-08-134, effective 5/28/04

Previous Version: WSR

04-08-021, effective

4/29/04

Previous

Version: WSR

02-01-135, effective 1/19/02 |

clarifying information

There are two types of income discussed in this section:

Ongoing wages / salary

-

Verification of income is

done at application, reapplication and when changes are reported during

the eligibility period. Verification can:

-

Pay stubs for the 3 most

recent months of employment or a current pay stub showing year-to-date

earnings

-

A written employer

statement indicating the gross wages earned and hours of

employment;

-

A note in the client case

record indicating the employer was contacted (by mail or telephone)

and the gross wages and hours were verified; or

-

The

DSHS 07-042B--Self Employment Income Report or other written

verification indicating gross income for self-employment; or

-

From other source such as

SEMS, ACES, SSI, statement of child support paid by non-custodial

parent, etc.

-

If there is not recent

income history, the verification can be self reported (for new

employment), or an

employer statement.

-

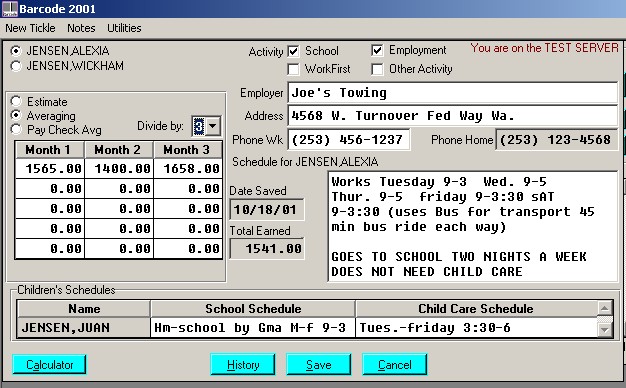

Use the following WCAP

functions to calculate earned income: The "Averaging" function

within the activity / schedule screen of WCAP is best suited to give

projected income when there is prior pay history information and at

reapplication.

-

Allows worker to input any combination of

totals for up to 3 months and have that information divided by up to 3.

-

The "divide by" must match the number

of months that income is entered for.

-

"Total earned" amount = All income

for months entered divided by the number # indicated in "Divide by"

field.

-

"Total Earned" amount transfers to

the income screen.

|

EXAMPLE 1

Deryl, a non-TANF

consumer, applies for child care in March. Deryl has been working as a

substitute teacher for the past five months. He expects no changes in

his employment situation "anytime soon" and the school

district confirms this. Deryl doesn't keep all his pay stubs, but his

employer reports his past gross earnings to be $1200 in December, $1400 in January, and $1325 in

February. Use the “Averaging” function to enter his last three

months of income and divide by three.

Deryl's income is averaged across multiple months

because historical wage information is available. Deryl's expected

average monthly income is about $1293 (the average of the 5 months of

income above).

|

|

EXAMPLE 2

Candy is self-employed and has been receiving WCCC for

the past year and a half. Her case is due for reapplication on 9/30. Candy has had an unusual dip in business over the past 3 months.

Candy's last three months of income would not

provide the best estimate of future income. Income from the past 9

months could actually be totaled and divided by 9 to get an estimate

of future income. Her

new eligibility and copayment can be based on more than the last 3

months of income. |

|

Example 3

Stacey is

an approved self employed WCCC consumer. At her reapplication she

turns in the self employment form 07-042B. She also supplies some

receipts to verify her deductions. Stacey reports she has a gross

income of $1,500 for May, $1,600 for June and $2,500 for July. She had

work related deductions of $300 each month. Use the averaging function

and enter $1,200, $1,300 and $2,200 for each month. Her average income

for the last three months is $1,567. |

|

Example 4

Using

Example 3 above, Stacey turns in receipts she has received from her

clients and the gross income for May-July is as noted above. She does

not claim any deductions. You allow a $100 standard deduction for each

month

(per memo dated November 29, 2001). Use the averaging method and

enter $1,400, $1,500 and $2,400. Her expected average monthly income is $1,767. |

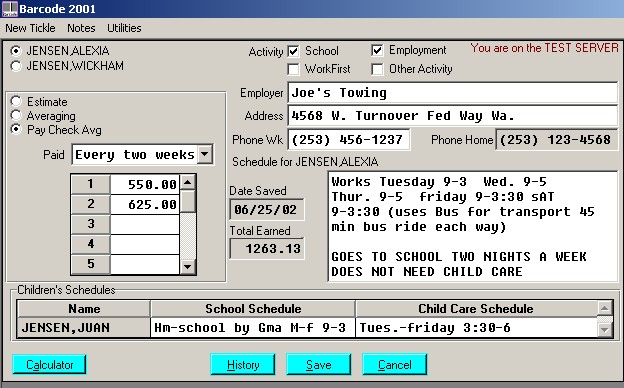

- The "Pay Check Averaging"

function within the activity / schedule screen of WCAP is best used to

average multiple paychecks for a single month.

- "Paid" drop down box lists payment cycles as weekly, every

two weeks, two times a month, and monthly.

- Allows up to 15 paycheck entries.

- Paycheck entries are added together, divided by the total number of entries

and the result is multiplied using current calculations: 4.3 if paid 1x

a week; 2.15 if paid every 2 weeks; 2 if paid 2x a month; and 1x if paid

monthly.

- "Total Earned" amount transfers to the income screen.

-

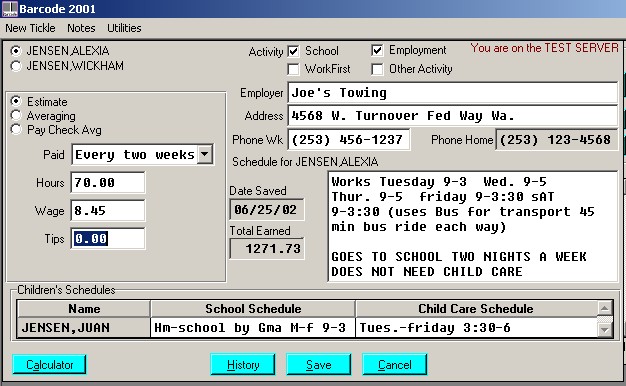

The "Estimate"

function within the activity / schedule screen of WCAP is best suited to

give projected income when there is new employment and no current pay

history or the income changes and their future income is anticipated to be

different than actual earned income. This function should not be

used at reapplication when pay history or an employer statement of actual

gross earnings could be used to determine expected average monthly income.

- "Paid" drop down box lists payment cycles as weekly, every

two weeks, two times a month, and monthly.

- "Hours" total should coincide with payment cycle, for

example: 25 hours weekly, 70 hours every 2 weeks, 80 hours 2x a month,

or 165 hours a month.

- "Total Earned" amount = ("Wage" x

"Hours") x 4.3 if paid 1x a week; 2.15 if paid every 2 weeks;

2 if paid 2x a month; and 1x if paid monthly.

- "Tips" amount will be multiplied by "Paid" and

added to the monthly total.

- Example: $50.00 in tips x 4.3; 2.15, etc. + "Total

earned."

- "Total Earned" amount transfers to the income screen.

|

EXAMPLE 1

Robert, a new WCCC applicant, reports that he will

start a new job on July 15. The department receives an employer

statement that indicates Robert will be paid once a month. He

will receive $0.00 in July, approximately $1500 in August and

approximately $3000 in September. To figure the expected average

monthly income using the WCAP, choose "paid" one time a

month. Enter the approximate number of hours to be worked in a

month, and the hourly wage. Given the following figures (165

hours a month X $18.00 an hour) X one payment cycle a month, the

expected average monthly income will be $2970. Use the $2970

figure to determine eligibility for the program beginning July 15 and

the ongoing copayment.

|

|

EXAMPLE 2

Regina’s case is up for reapplication

on 2/28. Over the past three months she was on a reduced work week due

to a physical injury. She is now returning to her normal schedule on

3/1 at her previous wages. Regina's last three months of income

would not provide the best estimate of her expected average monthly income.

Her wages and hours can be re-verified with the employer. |

- Using the last 3 months of income is a general

practice or standard for determining eligibility.

You can accept less verification or more verification, as the case

needs.

|

EXAMPLE

1

A family

that is self-employed shows a net loss of income at reapplication. At

previous reapplications they have had enough income to warrant full

time child care hours. The family can verify their income for the last

12 months (instead of just the last 3 months). You can divide this

income by 12 then apply WAC 388-290-0050 to the amount to determine

the number of child care hours allowed.

|

|

EXAMPLE

2

At

reapplication in October, Bill turns

in only his most current pays stub. You can use Bill’s

year-to-date (YTD) total gross income to determine his expected

average monthly income

amount by dividing the number of:

-

Months

the pay stub covers; or dividing

-

Pay

periods the pay stub covers and multiplying it by how often Bill is

paid a month.

Bill’s YTD

total gross income is $15,875.37. You know that Bill is paid twice a

month and his stub covers 17 pay periods. You calculate his income as

follows:

Bill’s

average pay stub total is $15875.37÷17=$933.85

Bills

average monthly total income is $933.85*2=$1867.70

|

-

Lump Sum payments

Examples of lump sum payments are back child support, gambling winnings,

an inheritance, or money from property sales. Lump sum payment

totals are divided by 12 months, considered expected average monthly income

and only counted against the month it is received and the remaining months

in the current eligibility period. Income tax returns, cash diversion payments, TANF Early Exit

bonuses and other payments listed in WAC 388-290-0070 are not countable lump

sum payments.

A consumer may be determined

ineligible at application or reapplication due to a lump sum payment

received the month they apply. When

this occurs, the consumer is ineligible only for the month they apply. The

lump sum payment is not counted towards eligibility if they apply the

following months.

|

|

EXAMPLE 1

Mary Lou is a non-TANF consumer receiving child care. Her expected average monthly income is $1032.

Her countable income is also $1032. Her WCCC copayment is $50. She

is authorized for care from May 1 to September 30.

Mary Lou reports that on June 5th she received a lump sum

payment of $4,800 for back child support. The AW averages Mary Lou's lump sum over 12

months ($4,800÷12 = $400), and $400 is added to Mary Lou's

average monthly-expected income. In addition, she is now receiving her

regularly scheduled child support payments of $300 per month. This raises

her countable income to $1,732 ($1,032 + 400 + 300). While Mary's income has

increased significantly, she remains eligible for WCCC and her copayment

remains the same through the current authorization period (See WAC 388-290-0085).

The lump sum amount divided by 12 ($400) is counted toward

the period of June 5th to September 30th. No amount of

the lump sum is counted toward income for the next eligibility period.

|

|

EXAMPLE 2

In the previous example, Mary Lou was still eligible for

child care.

If Mary Lou's lump sum payment had put her over 200% of the FPL for her family size, she would be ineligible only

for the remaining months of the current eligibility period. She reports the

lump sum on June 5th. Given a ten-day notice, she would be

ineligible June 15th through September 30th. She could

reapply for child care in October.

|

|

EXAMPLE 3

In the same case

as examples 1 and 2, Mary Lou does not report the change. The worker

discovers it at Mary Lou’s reapplication in September. Take the lump sum

payment and apply it to her income in June to determine if she remains under

200% of the FPL from June 16th-September 30th. If she is over the program

eligibility, process an overpayment. No amount of the lump sum payment

received in June is counted towards her new eligibility period if she

applies for care after September. |

|

EXAMPLE 4

Mary Lou applies

for WCCC in May. She reports a lump sum payment received in May. The payment

is divided by 12 and applied to her expected average monthly income. The total income places

her over 200% of the FPL. Mary Lou is denied WCCC for May but could re-apply

for eligibility starting June 1st. |

worker responsibilities

-

When available income verification is from pay

stubs, an employer statement of gross wages earned (not expected

schedule or hourly wage), or a W-2 from previous months, determine

expected monthly income by totaling the amount earned and averaging the

amount over the number of months in which it took to earn the income.

-

Averaging method; or

-

Income averaging method.

Consider whether the consumer is paid

weekly, twice a month, every two weeks, or monthly when entering pay

check averaging information.

-

When there is no previous wage information

available, such as pay stubs or a W-2, the consumer may provide an

employer's statement (verbal or written) that shows current hourly wage.

Determine the expected average monthly income by:

-

Multiplying weekly income by 4.3 if the

consumer is paid once a week;

-

Multiplying bi-weekly income by 2.15 if the

consumer is paid every two weeks;

-

Multiplying semi-monthly income by 2 if the

consumer is paid twice a month; or;

-

Using monthly income if the consumer is

paid once per month.

-

Allow the consumer to itemize or use the

standard 100.00 deduction when they are self-employed. The Clarifying Information under WAC 388-450-0085 lists

examples of deductions.

Please see memo from November 29, 2001.

-

Take into consideration the following when

determining expected average monthly income if the consumer has

commission or overtime pay in addition to an hourly / monthly wage:

-

Is the commission pay on-going, and

-

Does the amount vary due to seasonality of

the industry?

|

EXAMPLE 1

Sara works in retail and averages 34 hours a week and

$1400 a month (gross). During Nov., Dec., and Jan., she averaged 50

hours a week and received commission on her sales. Her reapplication was due

in December. Looking at Sara's recent income, the AW must determine if the

increased income in Nov. Dec., and Jan. would have made Sara

ineligible. If not, no action is taken.

Determine future eligibility beginning January 1st.

Sara's overtime and commission pay has ended and she will resume her

34-hour a week schedule. Future eligibility based on Sara's normal 34-hour

work-week.

|

|

EXAMPLE 2

Chuck receives both a base wage and commission each

month. His commissions vary considerably. The AW must include the commissions

when determining expected average monthly income. Averaging past

earned commissions over the time it took to earn them would give the AW an accurate idea of how much

to count toward the average monthly expected income.

|

- If the consumer has bonus pay in addition to an hourly / monthly wage,

take into consideration the payment schedules bonuses may take such as a

regular scheduled payment (such as monthly or quarterly) or at certain

times of the year (such as during the holidays). Count all bonuses as

income regardless of the method of distribution (either as ongoing income

or lump sum payments).

The difficulty with bonuses begins when there is not a way to predict how

much the bonuses will be. Use the following as a guideline when dealing with

employee bonuses:

Bonuses paid on a monthly schedule:

Treat like ongoing wages/salary according to the WCCC handbook. If

previous bonuses have been received, average the amount and apply to the

monthly countable income. Bonuses without any pay history are projected

based on employer information and applied to monthly countable income. If

the bonus payment schedule is monthly.

Bonuses received on any other time schedule other than monthly:

Treat as a lump sum payment and apply lump-sum payment process to

determine monthly countable income.

|

EXAMPLE 1

Patsy’s

employer pays out bonuses on a monthly schedule based on the previous

months profit. At her reapplication, her pay stubs show she received a

bonus for 2 of the last 3 months. Take the total bonus amount and divide

by 3 to determine the amount to add to her monthly income. |

|

EXAMPLE 2

Patsy’s employer pays out bonuses twice a year based on the company’s

profits. At reapplication, one of her stubs shows she received a bonus of

$3,000. Divide the bonus by 12 to determine the amount to add to her

monthly income. |

| NOTE: |

Commission and bonus pay can be included as part

of the "total income" by placing the amount in the

"Other" column on the Income Eligibility or by adding it to

the averaging or pay check averaging functions on the Activity/Schedule

screen in the WCAP. |

-

Countable income includes earned income and

unearned income. All countable income is entered on the

Income/Eligibility Information screen.

-

To determine countable income and eligibility:

-

Subtract verifiable child support paid out

(including arrears)

from the expected monthly income.

-

Determine whether the family is income

eligible by comparing countable income to 200% of the FPL. If countable income

exceeds 200% of the FPL for

their family size, the family is ineligible for WCCC.

| NOTE: |

The WCAP

determines eligibility and copayment when you enter the necessary

information. The WCAP program should be used at all times. |

-

If eligible, send the consumer the

DSHS

07-066(X), The Award / Change Letter. A copy is automatically

imaged into the electronic case record (ECR).

-

If ineligible, send the consumer the DSHS

15-247(X), Working Connections Child Care Denial/Termination Notice.

A copy is automatically imaged into the ECR. A copy is

automatically imaged into the ECR.

|

|